-

Recently Browsing 1 member

-

Latest Activity

-

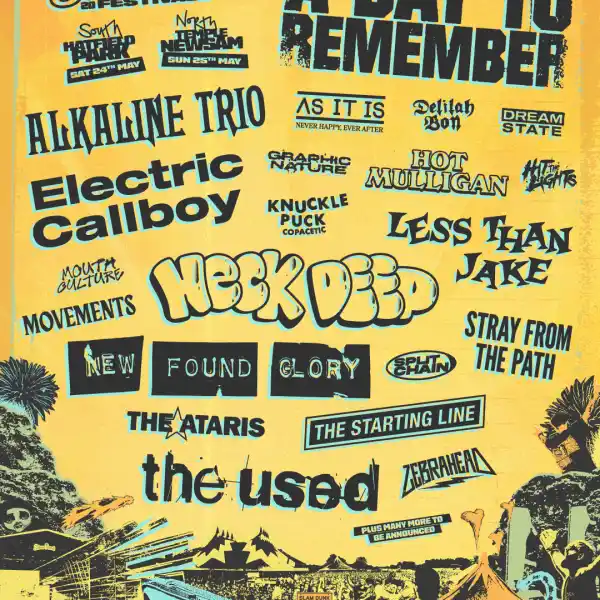

Not saying they’re trying too but they’ve gone big on band bookings and it all adds up and they’ve slowly dropped stages over the years so something has to give eventually but I guess letting ADTR do 2 Brixton shows would’ve saved them some money and the high ticket price would potentially allow them to not drop anymore stages. I wouldn’t be against it because the sound clash was so bad last year with the key club stage.

-

By DomDom1984 · Posted

That lineup doesn't strike me as one from a festival desperate to cut corners. -

By DomDom1984 · Posted

Absolutely no chance. They're literally just starting as potential headliners. -

By MEGATRONICMEATWAGON · Posted

After his heroics, get Bon Jovi in as the Legend!! BBC News - Jon Bon Jovi praised for talking woman off bridge https://www.bbc.com/news/articles/cjrder972xgo -

As a business they need to cut corners somewhere with rising costs and losing another stage might be the way forward. There was a big issue with sound clash in south with the ska stage and the key club, the north had a similar thing with the key club and heavier stage. Might just be an idea to get rid of the key club and spread those bands out across the lineup or make the key club stage 2 stages in the tent, back to back again (so could still have 5 stages this way). 3 outdoor and the tent with 2 stages. Could work.

-

-

Latest Festival News

-

Featured Products

-

Monthly GOLD Membership - eFestivals Ad-Free

2.49 GBP/month

-

-

Hot Topics

-

Latest Tourdates

Recommended Posts

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.