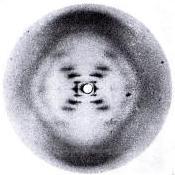

Cost of Living and Glastonbury

cost of living and Glastonbury

344 members have voted

-

1. with the cost of living rising will this impact the decision to buy Glastonbury tickets ?

-

Yes ... im already priced out8

-

I will try in oct but a decent chance I wont pay off balance6

-

I will try in Oct and it likely ill pay off balance but not 100% sure55

-

I will purchase them as usual and pay off as usual275

-

-

Recently Browsing 0 members

- No registered users viewing this page.

Recommended Posts

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.