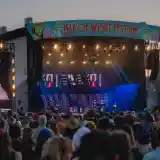

Isle of Wight Festival 2018

Thursday 21st to Sunday 24th June 2018Seaclose Park, Newport, Isle of Wight, PO30 2DN, England MAP

weekend £209 SOLD OUT day tickets still available

Why is there only one competition authority? That's the bad joke out of the way.

The government's Competition & Markets Authority is currently investigating music group Live Nation's ownership of the Isle of Wight Festival, to see whether the recent acquisition will "result in a substantial lessening of competition" within the festival marketplace. Live Nation own or part-own a number of the largest festivals including Download, V Festival, Reading/Leeds, Parklife, Creamfields, Lovebox, Wilderness and more.

The AIF (the Association of Independent Festivals) - whose membership includes festivals large and small including Barn On The Farm, Beat-Herder, Belladrum Tartan Heart, Bestival, Boomtown Fair, Blissfields, Bluedot, Boardmasters, and Burning Lantern (and that's just the B's) - are urging that the scope of the investigation is widened, to include a look at Live Nation's wider position in the live music market, where they also operate venues, ticketing and secondary ticketing outlets, artist management companies and more.

Research by the AIF says that Live Nation own or control 23% of the festival audience* within events of greater than 5,000 capacity, and that the addition of Isle of Wight Festival will add a further one percent. Along with their other live music business operations, almost all artists are likely to have dealings with them at some time.

(* by an event's daily capacity, not necessarily the total audience number).

Live Nation's 24% is certainly a strong position, particularly when their nearest competitor Global, who own or part-own Victorious, Boardmasters, Rewind, Y-Not, Kendal Calling, Truck, and more, control an 8% share according to the same research. Almost-all of the other operators run just one or two events, and often on the smaller scale.

The AIF's concern is that with such a concentration of power across the live music value chain most artists will have little choice but to work with Live Nation at some point in their career, and around so-called “exclusivity deals” whereby artists can effectively be restrained as to where they can and cannot perform and the pool of talent available to non-Live Nation events is greatly reduced.

Commenting on the research and the “profound and serious consequences” of Live Nation’s vertically integrated approach, General Manager of AIF Paul Reed said: "For the sake of its future health and diversity it is vital that the UK’s live music sector remains open and competitive. We continually need new artists to break through, and entrepreneurs to launch fresh and exciting events. "

"The live music sector is fiercely competitive, but data we have published today rings several alarm bells - highlighting that a single transnational corporation is fast-headed towards widespread dominance. For independent festival operators, a Live Nation monopoly would quite simply be a stranglehold with profound and serious consequences."

“The complaint we hear privately from a growing number of AIF members is about the collateral damage caused by the imposition of hugely restrictive exclusivity deals. By their nature, these deals are anti-competitive, restraining when and where even the smallest artist can perform and significantly diminishing the pool of talent that non-Live Nation promoters can draw upon. On this basis, we have urged the CMA to extend their investigations beyond acquisition of The Isle of Wight Festival and into Live Nation’s position in the market overall.”

Latest Updates

Isle of Wight Festival 2025

Isle of Wight Festival 2025festival details

Isle of Wight Festival 2025

Isle of Wight Festival 2025line-ups & rumours

Early Bird Tickets For IOW 2025 Now On Sale

Early Bird Tickets For IOW 2025 Now On SaleThe legendary IOW Festival returns on the 19th-22nd June 2025

Isle Of Wight 2024 - The Review

Isle Of Wight 2024 - The ReviewFive-star festival experience in glorious weather

Isle of Wight Festival 2024

Isle of Wight Festival 2024photo galleries